Financial Wellness

A three-year pause on student loan payments will end this summer regardless of how the Supreme Court rules on the White House plan to forgive billions of dollars in student loan debt.

The deadline to file your taxes has arrived. Whether you do them by yourself, go to a tax clinic or hire a professional, navigating the tax system can be complicated.

If you receive payments via apps like Venmo, Zelle, Cash App or PayPal, your tax reporting requirements will change next year.

If you’re expecting a tax refund, it could be smaller than last year. And with inflation still high, that money won’t go as far as it did a year ago.

Apple is getting into the buy now, pay later space with a few tweaks to the existing model, including no option to pay with a credit card.

NEW YORK (AP) — A software developer twice invested his savings in cryptocurrencies, only to lose it all.

A new AP-NORC poll shows that personal finances are a major source of stress for about half of the lower income households in the U.S..

As the Federal Reserve raises interest rates again, credit card debt is already at a record high, and more people are carrying debt month to month.

More employers are posting salary bands for job postings, even in states where it’s not mandated by law.

The job market in the U.S. remains strong overall, but recent high-profile layoffs at technology and media companies and predictions of a recession later this year have raised concerns about job security.

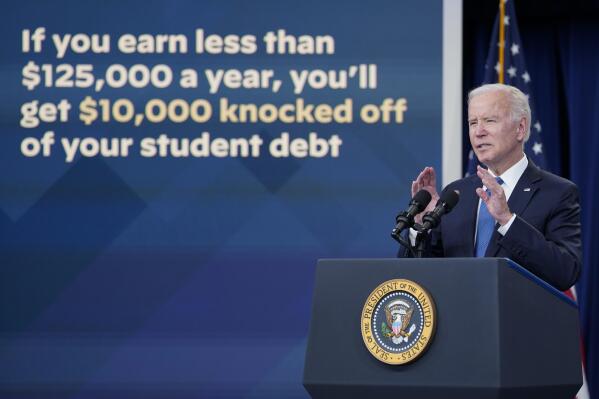

The fate of President Joe Biden’s student loan forgiveness plan is up in the air after Supreme Court justices questioned whether his administration has the authority to broadly cancel federal student loans.

A low credit score can hurt your ability to take out a loan, secure a good interest rate, or increase a credit card spending limit.

Money might not be the most romantic topic for Valentine’s Day, but talking about finances with your significant other is a key element of a healthy relationship.

The Internal Revenue Service is recommending that taxpayers hold off on filing their tax returns for 2022 if they received a special tax refund or payment from their state last year.

The Federal Reserve raised its key rate by a quarter point Wednesday, bringing it to the highest level in 15 years as part of an ongoing effort to ease inflation by making borrowing more expensive.

Tax season is here again. Whether you do your taxes by yourself, go to a tax clinic or hire a professional, navigating the tax system can be complicated.

The holidays are supposed to be a joyful time, but they can also be financially stressful. With gifts, social gatherings and plane tickets home, the costs can start piling up.

The Federal Reserve’s move to raise its key rate by a half-point brought it to its highest range in 14 years.

After reaching 40-year highs over the summer, price increases in the U.S. are now steadily easing. Consumer inflation slowed to 7.1% in November from a year earlier and to 0.1% from October, the government said Tuesday.

NEW YORK (AP) — Consumers holding out for big deals — and some much-needed relief from soaring costs on just about everything — may be disappointed as they head into the busiest shopping season of the year.

President Joe Biden’s plan to provide up to $20,000 in federal student loan forgiveness has been blocked by two federal courts.

Mortgage rates continue to jump, home sales slump and credit cards and auto loans increase. Savings rates are slightly juicier, though.As the Federal Reserve rapidly increases interest rates, many economists say they fear that a recession remains inevitable in the coming months — and with it, job lo

NEW YORK (AP) — Starting this week, job-seekers in New York City will have access to a key piece of information: how much money they can expect to earn for an advertised opening.

President Joe Biden’s student loan forgiveness plan, announced in August, will cancel up to $20,000 in debt per borrower.

Tens of millions of older Americans will see a major increase in benefits this January when a new cost-of-living adjustment (or COLA) is added to Social Security payments.

While most Americans say having a good standard of living is important, more than half believe it’s unlikely younger people today will have a better life than their parents, according to a new poll.

The Free Application for Federal Student Aid period opens Oct. 1 for the 2023-2024 school year. If you plan to attend college next year, you might want to fill out the FAFSA application as close to the opening date as possible.

When President Joe Biden announced a plan to forgive student loan debt, many borrowers who kept making payments during the pandemic wondered if they’d made the right choice.

Mortgage rates have jumped, home sales have slumped and credit cards and auto loans have gotten pricier. Savings rates are slightly juicier, though.

If you shop online for clothes or furniture, sneakers or concert tickets, you’ve seen the option at checkout to “buy now, pay later” by breaking the cost into smaller installments over time.

Rents are starting to come down after spiking to record levels this past summer, but experts are uncertain if the slowdown will continue.